Flexible Leasing and Financing Solutions

Specializing in equipment finance with experience across industries, Contend Capital will provide the optimal financing solution to capitalize on tax savings and enhance business cash flows.

Finance

Agreement

Equipment finance agreements are straight finance contracts where the business secures title to the equipment. Finance agreements allow businesses to take advantage of IRS Section 179. EFAs are preferred over bank financing due to their ease of approval and flexibility in structure.

Apply NowCapital

Lease

With a finance lease, the business secures ownership of the equipment with little up-front cost. The company has the option to purchase the equipment for $1.00 or some other pre-agreed upon fixed price at the end of the lease term. The company benefits from IRS 179 tax deduction.

Apply NowOperating

Lease

Similar to a rental, the leasing company retains ownership of the asset and at the end of the lease term, the business has the option to purchase it, return it, or continue to lease it. Operating leases allow companies to expense 100% of the monthly lease payment when you need it most.

Apply NowSale

Leaseback

Under a sale-leaseback, the business sells its assets to the lender, immediately lending it back to the client. The owner receives cash for the equipment and potential improvements to the balance sheet and P&L. Cash toward depreciating equipment can then be better utilized elsewhere.

Apply NowFinance Agreement

Equipment finance agreements are straight finance contracts where the business secures title to the equipment. Finance agreements allow businesses to take advantage of IRS Section 179. EFAs are preferred over bank financing due to their ease of approval and flexibility in structure.

Apply NowCapital Lease

With a finance lease, the business secures ownership of the equipment with little up-front cost. The company has the option to purchase the equipment for $1.00 or some other pre-agreed upon fixed price at the end of the lease term. The company benefits from IRS 179 tax deduction.

Apply NowOperating Lease

Similar to a rental, the leasing company retains ownership of the asset and at the end of the lease term, the business has the option to purchase it, return it, or continue to lease it. Operating leases allow companies to expense 100% of the monthly lease payment.

Apply NowSale-Leaseback

Under a sale-leaseback, the business sells its assets to the lender, who immediately lends it back to the client. The owner receives cash for the equipment as well as potential improvements to the balance sheet and P&L. Cash committed to highly depreciating equipment can be better utilized elsewhere.

Apply NowFlexible Payments

Customized financing structures and payment options help to better match revenue generation to your monthly equipment expense, giving you the flexibility to meet business objectives.

Not sure which structure is right for you?

Contact UsSecure Equipment Financing in Four Easy Steps

Apply Online

Complete a simple, 2-minute online application requesting basic business and owner information.

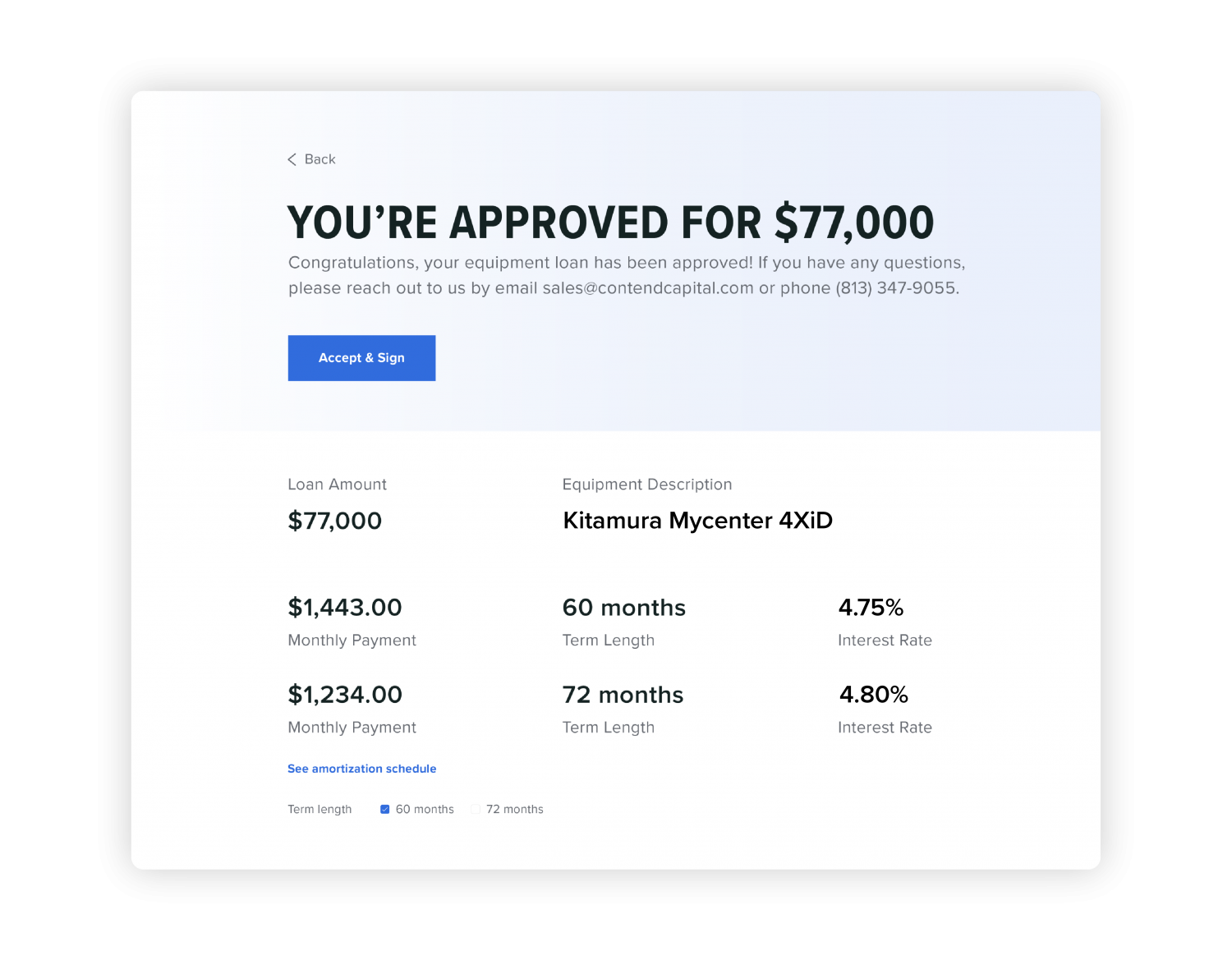

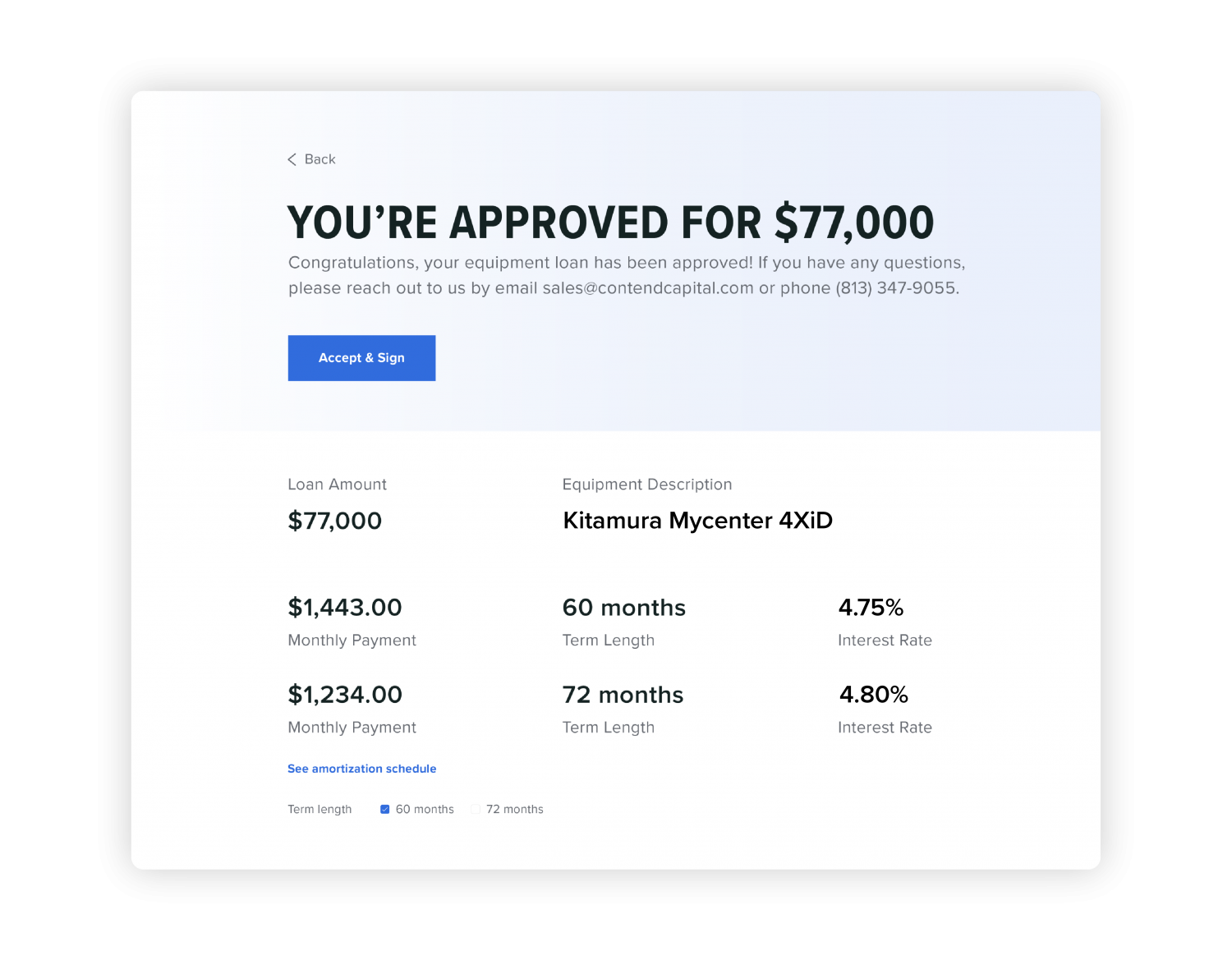

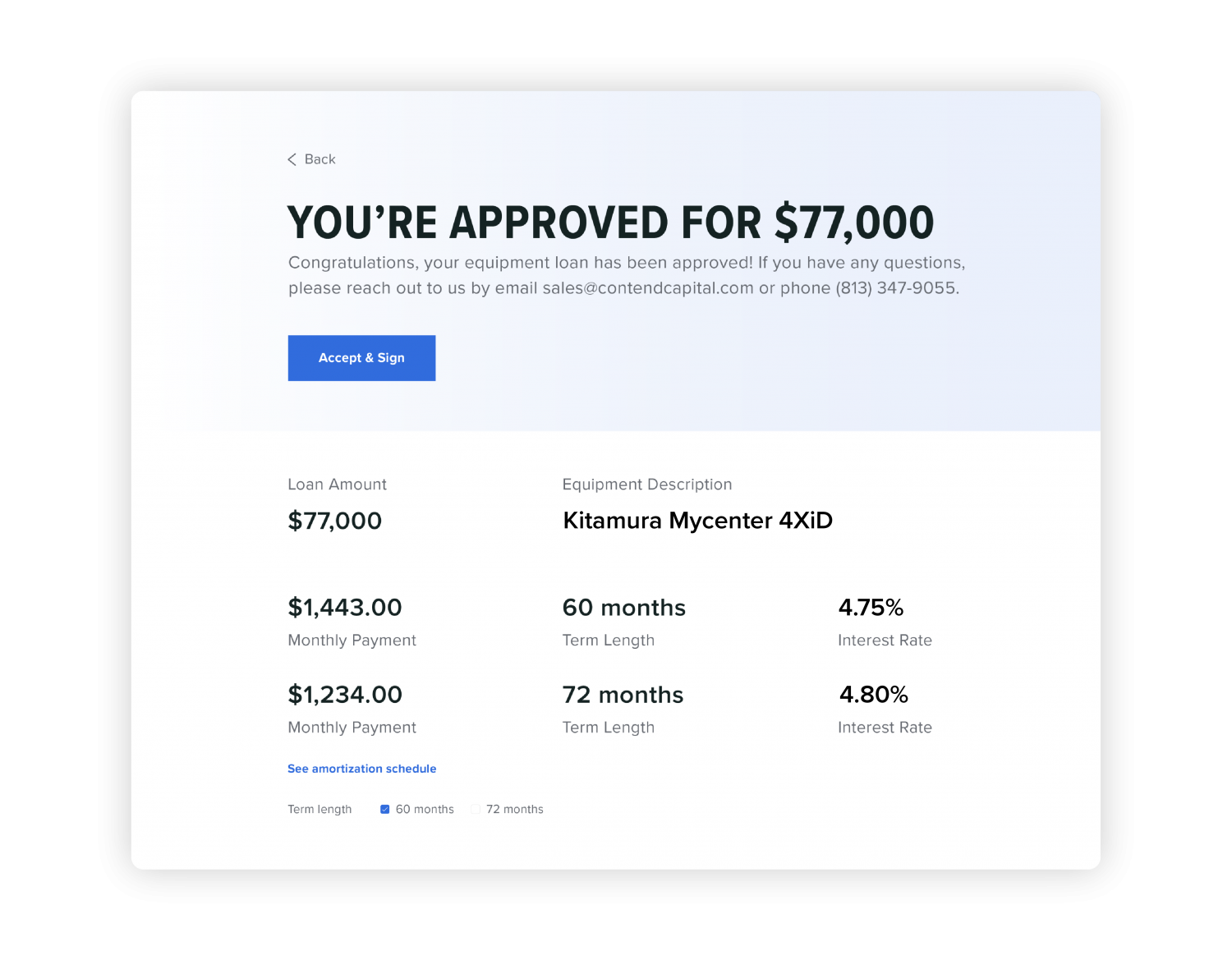

Get Approved

Receive a finance approval outlining the terms and payment options available to your business.

Sign Documents

Within hours, receive the finance agreement to review and sign.

Get Financing

Funds are disbursed to finalize the transaction.

Receive a Quote

Won’t affect your credit.

No obligation.